Your Ultimate Guide for Service Benchmarking

Grow your services with evidence-based data and insights.

Download for later reading (PDF)

The Complete Guide

Everything you need to start benchmarking your service business today.

Download and read laterEven though more and more manufacturing companies see service as a strategic growth driver, service executives still need to juggle and guess too much. They lack the evidence-based and unbiased data and insights they need to establish well-grounded service strategies, gain strategic buy-in and continuously develop their services at the right pace.

While benchmarking is quite common for most functions, it is not for services.

That is why we have compiled this guide. You will gain insights into how service benchmarking will benefit your business when different types of benchmarking and other sources of data and insights might come in handy and what the best approach is for service benchmarking.

Keep reading or use the chapter links below to jump ahead.

What is service benchmarking?

What is the purpose of service benchmarking?

What are the different types of benchmarking?

What are the sources for service benchmarking?

What are the benefits of service benchmarking?

Why is service benchmarking so important?

What topics and metrics to benchmark for service?

What is the best benchmarking process?

What is the cost for service benchmarking?

What are the limitations of benchmarking?

What are common mistakes?

Or

What is service benchmarking?

Service Benchmarking is a process of evaluating service businesses of several companies or business units by comparing them with each other or with a standard.

The objective of service benchmarking is to highlight the strengths and weaknesses of service businesses as well as the opportunities and threats coming from the rapid developments in services.

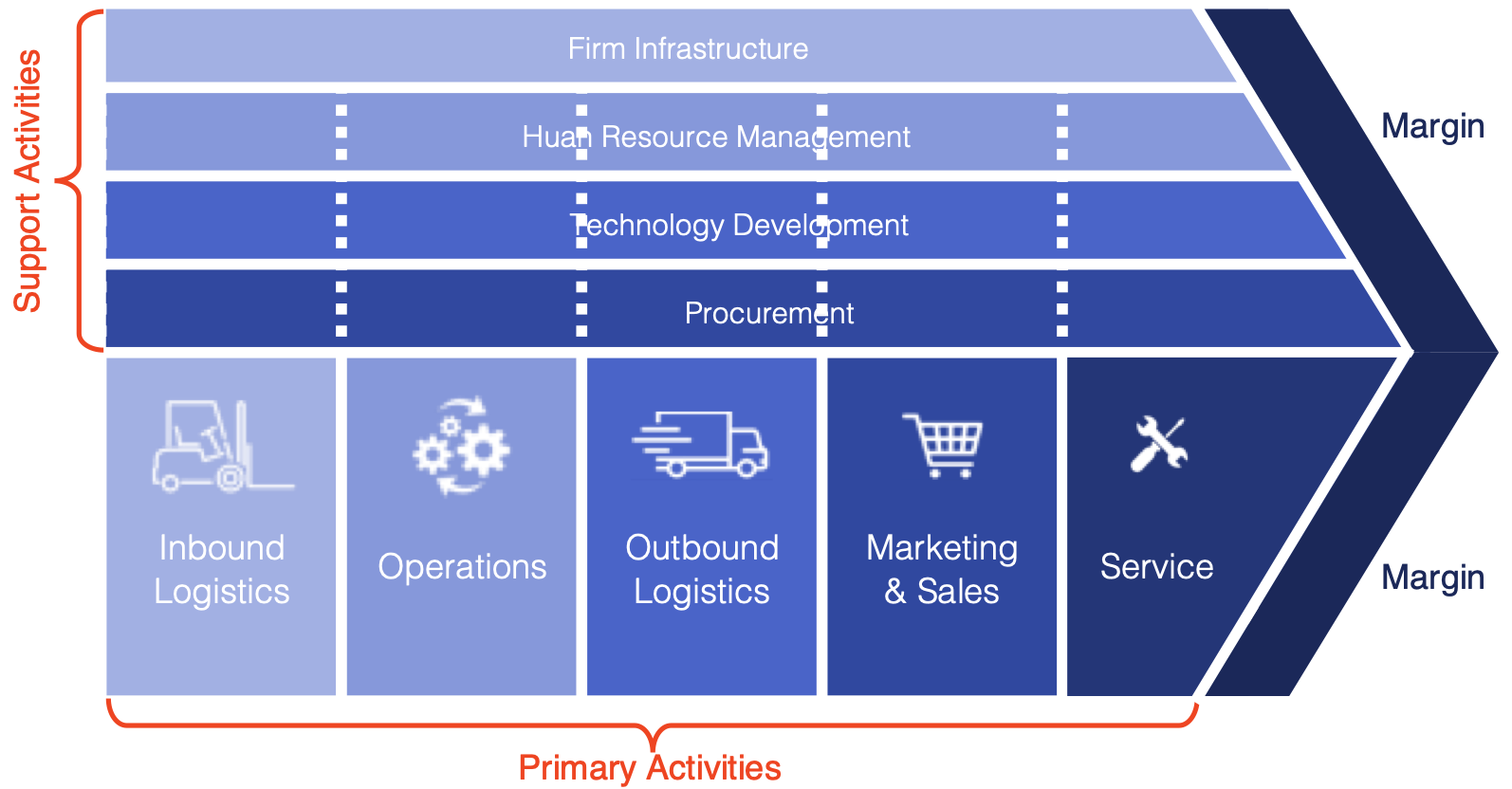

As service is becoming increasingly important for the success of a manufacturing company and service models are rapidly developing, service benchmarking tends to be comprehensive, covering:- Maturity level and performance of the service offerings and value proposition.

- Maturity levels of key service business capabilities.

- Performance levels of key service business capabilities.

- Cost levels and structure of the service operations.

- Investment levels for adopting new technologies and developing service capabilities and offerings.

- Monitoring trends in services.

What is the purpose of service benchmarking?

In your ongoing endeavour to grow and enhance your service business, you need adequate references to assess the current situation, the desired situation, the opportunities, and to develop ideas. And benchmarking is one of the valuable sources for such references

Particularly in business areas with little formal education, solid paradigms or certifications, the best source for such adequate references is benchmarking to reveal proven best practices.

Below are some examples of how service leaders use service benchmarking and leverage the data, insights, knowledge, and inspiration:

Periodical strategic assessment and strategy development

As services are increasingly seen as a strategic priority and business line that needs significant developments, service leaders want to advance their strategic assessment and analysis with external data and insights.

Today, service has become too important to use internal data and information for strategy development only.

Gaining strategic support and buy-in from executive stakeholders

Developing services requires changing priorities, insights, and mindsets for many stakeholders inside and outside the service business. It requires strategic decisions with significant stakes.

Without proper internal and external data to establish a well-grounded service strategy, these decisions become a “dragons’ den” with too many political discussions and decisions.

Benchmark data will help develop a shared concern, a shared vision, and a shared strategy to allow services to thrive, enabling the business as a whole to thrive.

Securing investment budget

Growing services and making it a future-proof business requires investments and changing cost structures (like higher costs for remote monitoring, data analytics, knowledge management).

For a long time, service revenues and margins could grow without much investment. Today, there is not much low-hanging fruit left over.

Without investing in new service business capabilities, growth of service revenue and margins will soon stall or even fall behind the competition.

External benchmarking data helps develop a compelling argument for the need for higher investments and cost levels in certain areas.

Realistic goal setting

In endeavours to grow and advance service business performance, stretched - but achievable - goals must be set.

Without proper external data of how other service businesses perform, there is a risk of navel-gazing and falling behind competition without even knowing this is happening. Another risk is setting too ambitious goals on business aspects that do not make sense considering the performance developments of other service businesses.

Inspiring teams with evidence-based (emerging) best practices

During the digital disruption we are experiencing now, many new practices and paradigms emerge.

To continuously drive service innovation and growth, all teams need ongoing inspiration and insights on where the business is heading and how to advance it.

During disruptive times, benchmarking is the most up-to-date source of insights and inspiration.

External references for continuous improvement

For any continuous improvement program, benchmarking will enrich the identification of improvement opportunities.

What are the different types of benchmarking?

While there are many different forms of benchmarking, most will fall into one of the following categories:

Internal benchmarking

Internal benchmarking compares the performance of different internal teams, departments, or business units to look for best practices and share these throughout the company to improve overall performance. Internal benchmarking is particularly useful if:

- A company already has established and proven best practices and wants to share these across all entities.

- A company runs a global programme and wants to compare the progress of each entity towards a shared vision of the future state.

- Comparable industries are not readily available.

Performance benchmarking

Performance benchmarking compares the performance of your company’s products or services to those of other companies. Product and service features, price, quality, reliability, design, speed, and customer satisfaction are often compared.

Performance benchmarking is helpful to improve your product and service offerings and increase your market position.

As part of a competitive analysis, you may want to compare to your competitors. However, service benchmarking adds much more insights when comparing companies across similar industries. Many best practices will come from another industry than the one your company is in.

Capability or process benchmarking

Capability benchmarking compares the maturity levels and internal performance levels of your company’s business capabilities to those of other companies or to “best practice” standards.

This type of benchmarking helps you better understand how your business capabilities compare to others and how your company is developing these business capabilities compared to the service sector.

Capability benchmarking is particularly essential in business domains with rapid developments and many differences, like is the case in the service business.

Strategic benchmarking

Strategic benchmarking compares the business strategies of companies within and outside your industry. Strategic benchmarking relates to both the strategy and how strategies are created to be more successful in the longer term.

Strategic benchmarking is particularly useful to understand the winning strategies of the most successful companies to establish your business’ strategy.

Strategic benchmarking usually is not limited to specific industries but looks at strategies and developments within the general marketplace.

What are the sources for service benchmarking?

Depending on what benchmark data and information you are looking for, there are various sources you could tap into. However, there are quite some differences in terms of:

- Easy access.

- Cost (both out-of-pocket and internal resources).

- Accurate data.

- The refresh rate of data.

- Detailed and actionable insights.

Below you will find a description of the most common sources and an assessment of the advantages and disadvantages of each.

(Free) research projects

Many solution providers, consultancies, and associations conduct research projects to capture insights, engage their clients, demonstrate their thought-leadership, and generate sales leads. Participation in these research projects is free of charge and does not require much effort.

The results from these benchmark projects are shared with participants in the benchmark and with other (potential) clients. Often, a summary report is published for a broader audience as part of a marketing campaign.

Mainly, they cover relevant themes and provide some valuable high-level data and insights. The scope is often limited.

|

Pros |

Cons |

|

|

Via Google and other online sources, you can find a lot of information and data. Typically, you will find the summary reports of the various research projects and marketing information from service providers, consultancies, and associations.

|

Pros |

Cons |

|

|

Industry associations

Many industries have active and independent associations that collect data and practices to identify industry-wide trends and enable effective reviews of best practices. Some of them run ongoing or repetitive research to monitor relevant trends for their industry.

|

Pros |

Cons |

|

|

1-to-1 benchmarking

Instead of looking for external services for benchmarking, some service leaders compare metrics and practices with one or a couple of other service leaders in other companies in similar or completely different industries.

A few good practices to get more value from such 1-to-1 benchmarking are:

- Search for companies that are going through similar journeys and have similar maturity levels to ensure mutual benefits from the benchmarking exercise.

- Sign a mutual non-disclosure agreement to allow sharing of more detailed and sensitive information.

- Set up a proper structure and definitions for comparing metrics and practices.

|

Pros |

Cons |

|

|

Assessment against standards database or library

Some consultancies or specialised benchmarking service providers offer flexible benchmarking offerings. You submit data and receive a report on how you compare to the data in the database or library. These companies build their database and library from their clients over time.

|

Pros |

Cons |

|

|

Extensive assessment by consultancy

Many consultancies offer an assessment service specific for service businesses to reveal gaps and opportunities. Most consultancies offer this as an entry engagement to define the priorities and business case for the follow-up consultancy projects, which is their bread and butter.

|

Pros |

Cons |

|

|

Repetitive peer-benchmark

Some service providers provide a dedicated and repetitive benchmarking service as a core business. They repeatedly collect and report consistently to ensure a benchmark against both up-to-date and historical data.

|

Pros |

Cons |

|

|

Conclusion

Unfortunately, in service, there is hardly any professional and up-to-date benchmarking comparable to the benchmarking other functions like sales, marketing, supply chain, and manufacturing used to have.

However, with the sources and approaches described above, you can create your own mix of benchmarking sources to continuously have good external data and insights on your own service business, how that compares to others, best practices, and trends.

In summary, the table below can help to choose the best sources and approaches.

|

Need |

Best solution |

| In-depth assessment | • (Free) research project • Associations |

| Inspiration and learning from selected peers | • 1-to-1 benchmarking |

| Preparing or launching consultancy project | • Consultancy assessment • Peer benchmarking |

| Strategic assessment | • Peer benchmarking |

| Getting strategic buy-in | • Consultancy assessment • Peer benchmarking |

What are the benefits of service benchmarking?

Service benchmarking is a strategic tool for service executives, managers, product management, and innovators. It offers valuable external input for well-grounded and fact-based decisions and management.

Without being exhaustive, the most important benefits are:

- Understanding competition and how you compare.

- Evidence-based prioritisation and goal setting.

- Leverage your strengths.

- Monitor trends of the rapidly developing service business.

- Monitor progress and results of your service development.

- Reveal proven and emerging best practices.

- Foster outside-in thinking and willingness to change.

- Promote (internal) information sharing.

Understanding competition and how you compare

An apparent reason why service benchmarking is essential, is that it allows you to understand your competition better. Understanding how your competitors and similar companies in other industries run and develop their service business and what contributes to their overall success will enable you to have a well-grounded strategic assessment and service strategy.

Evidence-based prioritisation and goal setting

By comparing how your company runs and develops its service business, you can better prioritise areas of improvement. While service leaders and stakeholders understand the importance of continuous services development, they are often unsure where to start. Benchmarking helps to identify - with evidence - the areas where the gap with the best practice is the largest.

Leverage your strengths

Benchmarking can identify the areas where your service business is doing better than the competition and similar companies in other markets. This helps to leverage your strengths without over-investing in these areas.

Monitor trends of the rapidly developing service business

The service business is undergoing some significant shifts in most industries, if not all. Service businesses of manufacturers and pure service providers are quickly developing their service offerings, business models and operating capabilities. The adoption of new (digital) technologies is an essential driver of these changes.

As a result, we read a lot about visions, practices, success stories and new solutions. Too often, this information tends to be anecdotal, without hard facts to substantiate the information.

Repetitive service benchmarking provides the necessary data to:

- Validate and quantify the trends in service.

- Provide proof to which extent the emerging service models and capabilities drive success.

- Monitor the pace of the trend and to which extent it is accelerating or de-accelerating

Monitor progress and results of your service development

For sure, businesses should have programme management controls to keep track of the progress of the execution of their strategies.

With repetitive benchmarking, however, you can also track the progress of your strategic execution by:

- Taking a new snapshot of how maturity levels and performance levels compare to other service businesses.

- Comparing your progress with the progress of other service businesses.

- Assess the (longer term) pace of your development compared to other service businesses.

This is critical information, particularly in industries or business areas that are rapidly evolving, like services. Are you falling behind your competition, or are you ahead of the game?

Reveal proven and emerging best practices

Benchmarking is a great source to discover and learn about existing and emerging best practices if it also compares maturity levels of offerings, operating models, and business capabilities and correlates these with performance levels.

This offers good insights into how well other companies perform and what is driving their performance.

Foster outside-in thinking and willingness to change

Independent and trustworthy benchmarking provides neutral and fact-based insights to all relevant stakeholders in your business to understand the trends and how other companies run and develop their business.

Benchmarking also requires teams and individuals to ask new thought-provoking questions.

This brings - together with customer research, market research and industry research - critical external input to foster outside-in thinking for all stakeholders and teams to:

- Develop strategies.

- Decide on priorities and investment.

- Ideation for service innovation.

- Support the execution strategies.

- Drive continuous improvement.

Promote (internal) information sharing

Proper and repetitive benchmarking requires many teams and individuals to provide input for the benchmark, review the benchmark reports and act on the insights. It links sharing information with gaining insights and reaping benefits from it.

This promotes a culture of sharing information and practices across the (service) organisation’s departments and (regional) operating units.

Why is service benchmarking so important?

Very few service businesses use regular benchmarking of their performance, the maturity of their business capabilities and service developments. While in many other functions like marketing, sales, manufacturing, supply chain, this is a more common practice.

There are two strategically important reasons why service benchmarking has become mission-critical for a service business that is on its journey towards advanced services and service-oriented business models:

- Overcome the lack of proven service practices, knowledge, and paradigms.

- Service business needs more strategic and service thinking.

Overcome the lack of proven service practices, knowledge, and paradigms

In essence, there are two important reasons why we still lack evidence-based best practices, knowledge and paradigms for service business.

Service is not as mature as other business functions

Compared to many other business functions, like sales, supply chain and manufacturing, the service business is less mature. For example:

- There are very few management books and theories on service.

- There are very few (higher) education programmes at universities.

- Most service leaders had to develop their own frameworks and methods, learning from their peers and extensive experience.

Disruptive change

Nowadays, the service business is developing at a high pace and becoming more complex:

- New technologies are emerging and adopted.

- Customers are looking for ways to transfer risk and responsibilities to their vendors and service providers.

- Customers are demanding more support to improve their operational outcome by leveraging their data-driven capabilities.

- New competitors from other industries are entering the service space.

How benchmarking is the solution

Service leaders and innovators need to have evidence-based insights about best practices, emerging practices, new business models and operating models.

Typically, when we have few paradigms from long-standing research and are experiencing a rapid pace of development of practices, technology and strategies, benchmarking is one of the few sources for strategic assessment and continuous improvement.

Hence, regular benchmarking is the ultimate source for up-to-date insights and knowledge to manage, develop and grow your service business.

Service business needs more strategic and service thinking

More and more manufacturing companies have service development as one of the few strategic pillars. Their challenge is to:

- Develop new service offerings.

- Develop new business models.

- Grow the revenues.

- Improve customer loyalty.

- Increase product pull.

- Establish integrated, service-oriented business models.

So, service is evolving from an operational function to a strategic business domain, which requires more strategic and service thinking from service leaders, service innovators, and other business leaders in manufacturing companies.

It is therefore essential to understand the bigger picture of where the business is, where it needs to go, how it will get there and the opportunities and challenges.

Just as important, service leaders need to foster strategic discussions and, in so doing, strategic thinking, acting, and learning with all stakeholders. Ideally, the leader will help the teams to see and understand the bigger picture even as team members focus on the day-to-day work.

This requires strategic planning processes with adequate strategic analysis and insights.

There are many tools for strategic analysis and discussions. One is the analysis of your Strengths, Weaknesses, Opportunities, and Threats (SWOT). Such a SWOT analysis helps to conduct a strategic conversation about what is working, what is not working as well as things that need to be considered for the future.

In attempting to meet ambitious targets, business leaders can sometimes put on blinkers and focus on only reaching those targets. This approach steers their company away from the focused path and also insulates the company from observing and learning from what is happening in their industry.

Benchmarking is one of the critical tools to capture necessary information and insights on how other service businesses are developing and what drives their success. This continuous feed and analysis will give stakeholders the context and insights to increase momentum in strategic thinking.

What topics and metrics to benchmark for service?

As services in manufacturing industries are rapidly developing and we still lack unbiased and evidence-based insights into trends and best practices, you probably need to benchmark more than the typical performance metrics.

You also need to benchmark the maturity levels of your service business capabilities, (changing) cost levels and investment levels for the different (emerging) service business lines – or service models.

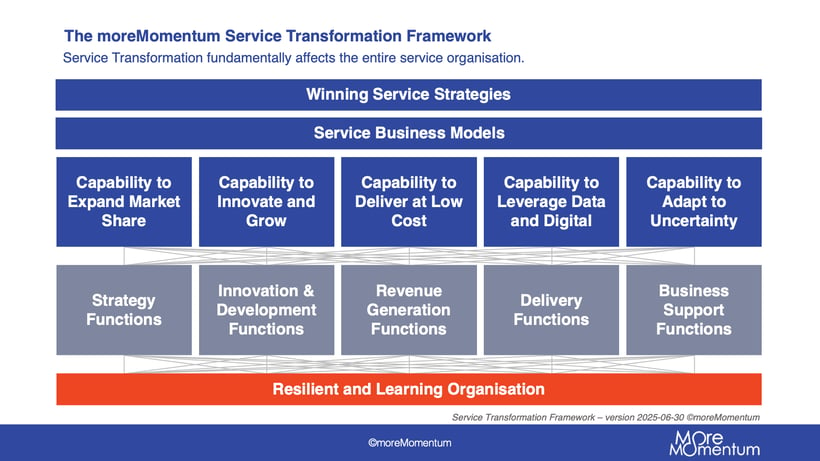

The moreMomentum Service Busines Capability Model provides a holistic and detailed framework of business capabilities and service models you want to benchmark.

For each (sub) capability and business line (see moreMomentum Service Business Capability Model above), you want to understand how the service industry in various sectors is evolving and how your service business compares on:

- Performance levels.

- Maturity levels.

- Cost levels.

- Investment levels.

- To which extent they are considered essential for (future) success.

Service business capabilities

Strategic Management

| Objective: | The business has a solid position to compete and thrive in a rapidly developing industry. |

| Description: | Develop a cascade of strategic plans for all functions and operating entities worldwide, based on well-grounded strategic assessment and analysis. Effectively execute service strategies across the entire organisation to ensure a good pace of advancing and growing the service business. |

Develop Services and Solutions

| Objective: | The business has a state-of-the-art, coherent, and complete portfolio of services and solutions that is highly valuable for clients and the company. |

| Description: | Develop existing and new service offerings and solutions based on an adequate assessment of changing customer needs and changing competitive landscape. Manage a solid portfolio of profitable services and solutions for todays and future success. |

Generate Demand

| Objective: | The business has a growing customer base with a high customer lifetime value. |

| Description: | Drive service coverage and contract penetration of the installed base and growth of existing and new advanced services at healthy price and margin levels. This requires advanced marketing and sales strategies and campaigns. |

Deliver

| Objective: | The business delivers services and solutions effectively and efficiently. |

| Description: | Develop and manage strong delivery capabilities to deliver existing and new services and solutions effectively and efficiently, driving customer value and satisfaction. |

Manage Customer Accounts

| Objective: | The business has profitable customers that successfully use the equipment, services, and solutions and have an excellent overall customer experience. |

| Description: | Manage strong customer relationships, driving overall customer success and growth of the share of wallet. Manage the portfolio of profitable clients. Continually involve equipment and/or service sales teams and service delivery teams. |

Innovate the Business

| Objective: | The business has adequate and forward-looking capabilities to develop processes and technology to adapt, develop and thrive. |

| Description: | Continuously develop the operating model and advanced capabilities. Adapt (emerging) technologies and infrastructure to keep up with the rapid development of service business. Collaborate with digital innovation and product development teams. |

Manage the Business

| Objective: | The core business is well enabled by support functions. |

| Description: | The core business is well enabled by support functions. Description: Develop and manage supporting and secondary capabilities, like human resources, knowledge management, maintenance engineering, supply chain, partnerships and finance to ensure resilient, effective, efficient operations and excellent customer experience. |

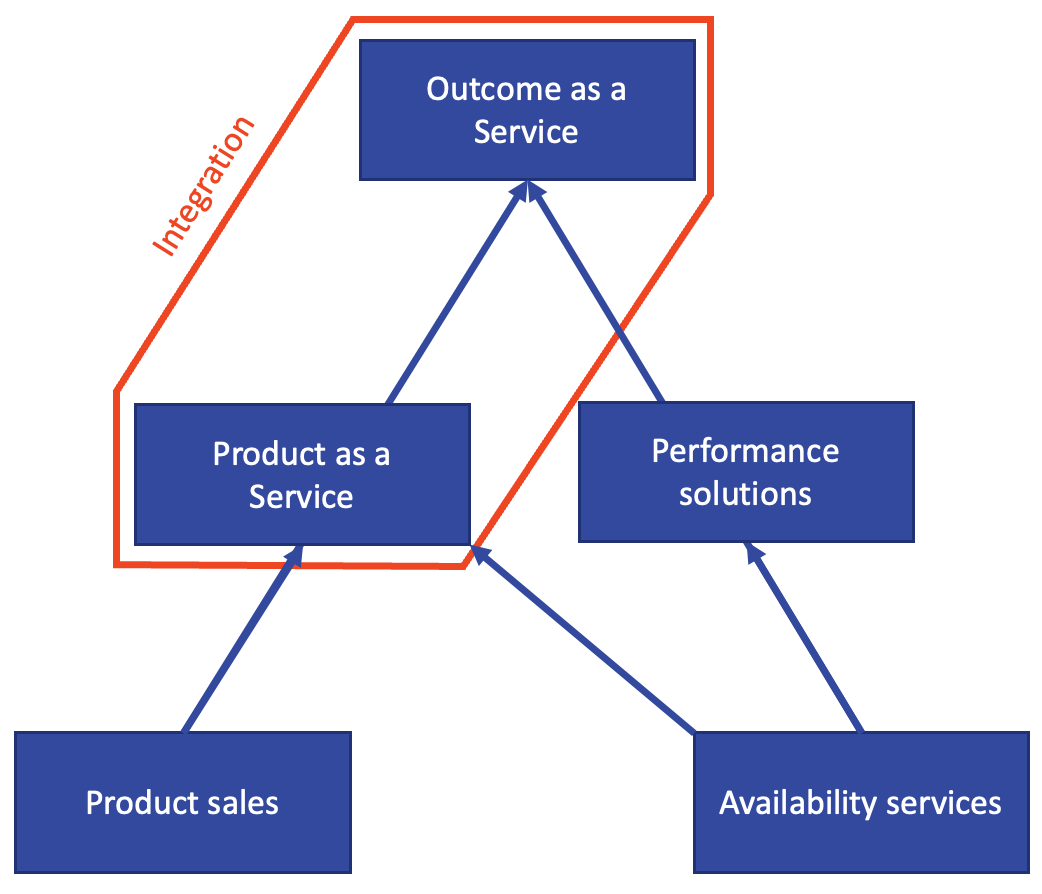

Service models

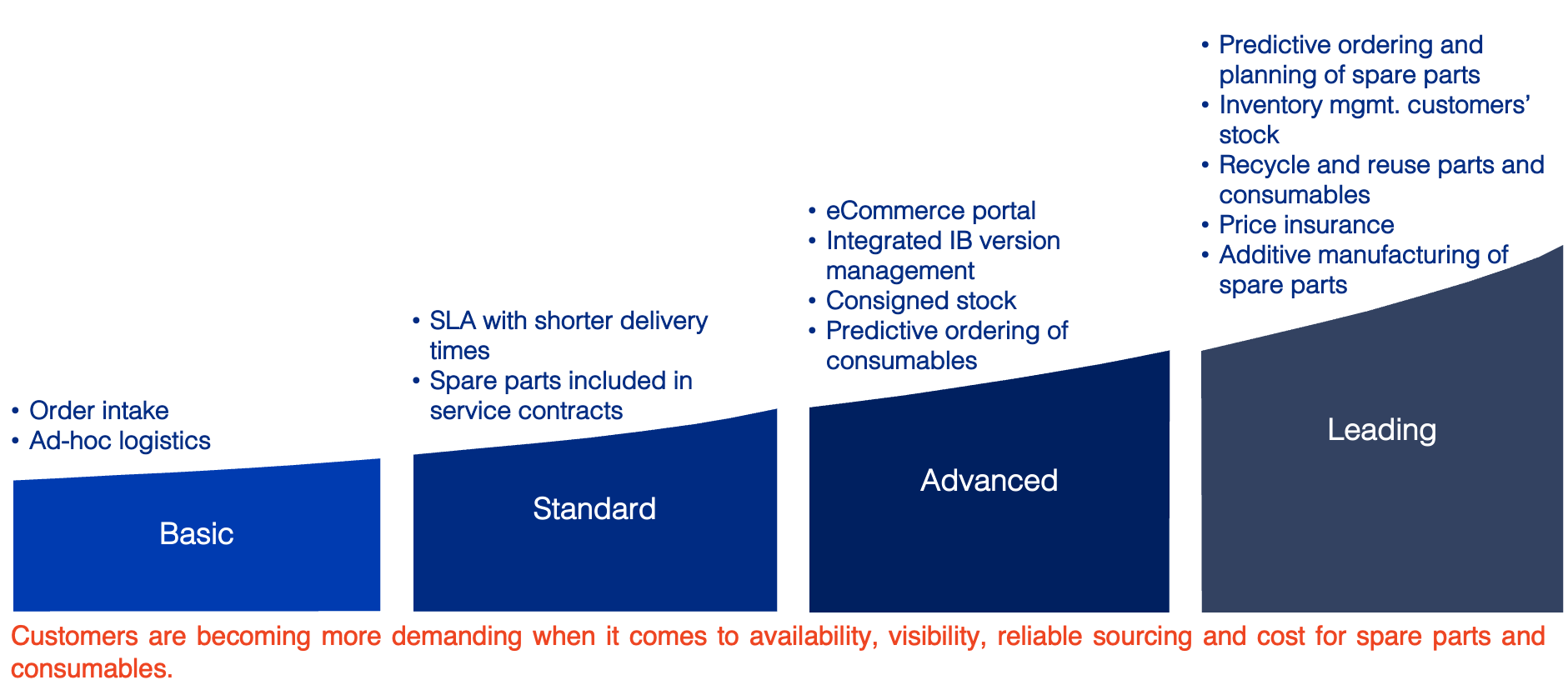

Spare parts and consumables

Many service businesses have significant revenue from selling spare parts, some also from selling consumables. This service business line is undergoing substantial developments in e-commerce, refurbishment, recycling, pricing strategies and advanced marketing and sales campaigns.

Customers are becoming more demanding regarding the availability, visibility and reliability of spare parts and consumables.

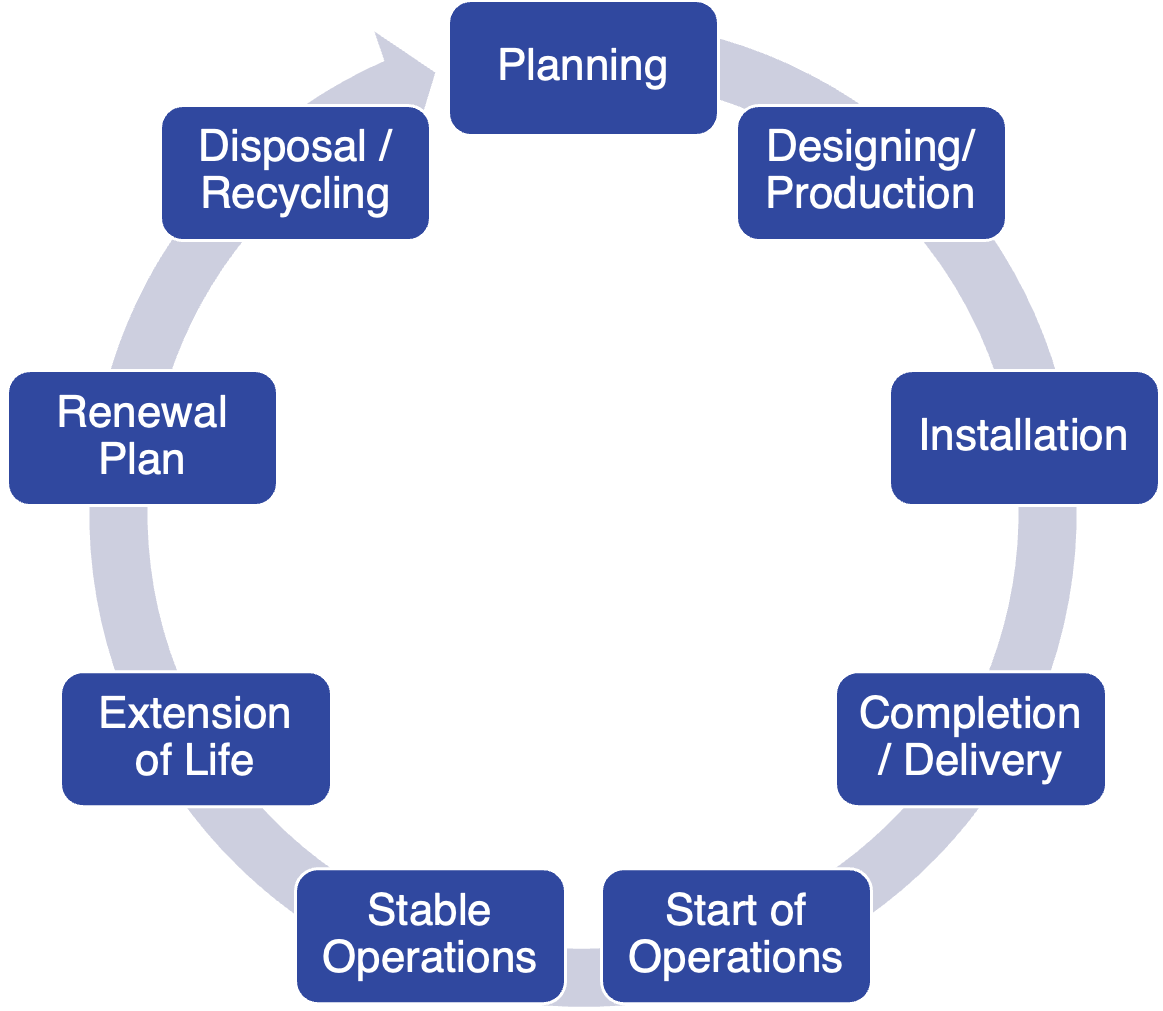

Product lifecycle services

In essence, product lifecycle services support customers in their asset lifecycle management functions, from acquiring equipment to disposal at end-of-life.

These product-related services can range from basic and reactive services - potentially offered free of charge - to very advanced, data-driven predictive and prescriptive services with complex performance-based agreements.

This could include assessments, consultancy, and education services.

Operational performance solutions

As your customers develop new (data-driven) capabilities and operating models, their needs will change significantly across all functions. This will have an impact on what support they need and what service providers they will engage with.

Most growth opportunities will be beyond equipment maintenance services, addressing more elements of the value streams of customers, like:

- Process and workflow improvement services.

- Operational data services.

- Yield improvement services.

- Energy reduction services.

With these services and solutions, manufacturers and service providers will focus on other customers’ KPI than uptime or Overall Equipment Effectiveness, but more on metrics that measure your customers’ outcome of their business capabilities or processes.

Integrated solutions

The more a manufacturer or service provider needs to offer a specific operational outcome to its clients, the more it needs to provide integrated solutions. A mix of hardware, software, data, and services is offered in one single value proposition and agreement.

There is an increasing demand for fully integrated and outcome-based services in which the supplier takes a significant portion of the operational complexity and risk away from customers.

This requires completely different capabilities and operating models than an equipment provider with good maintenance services.

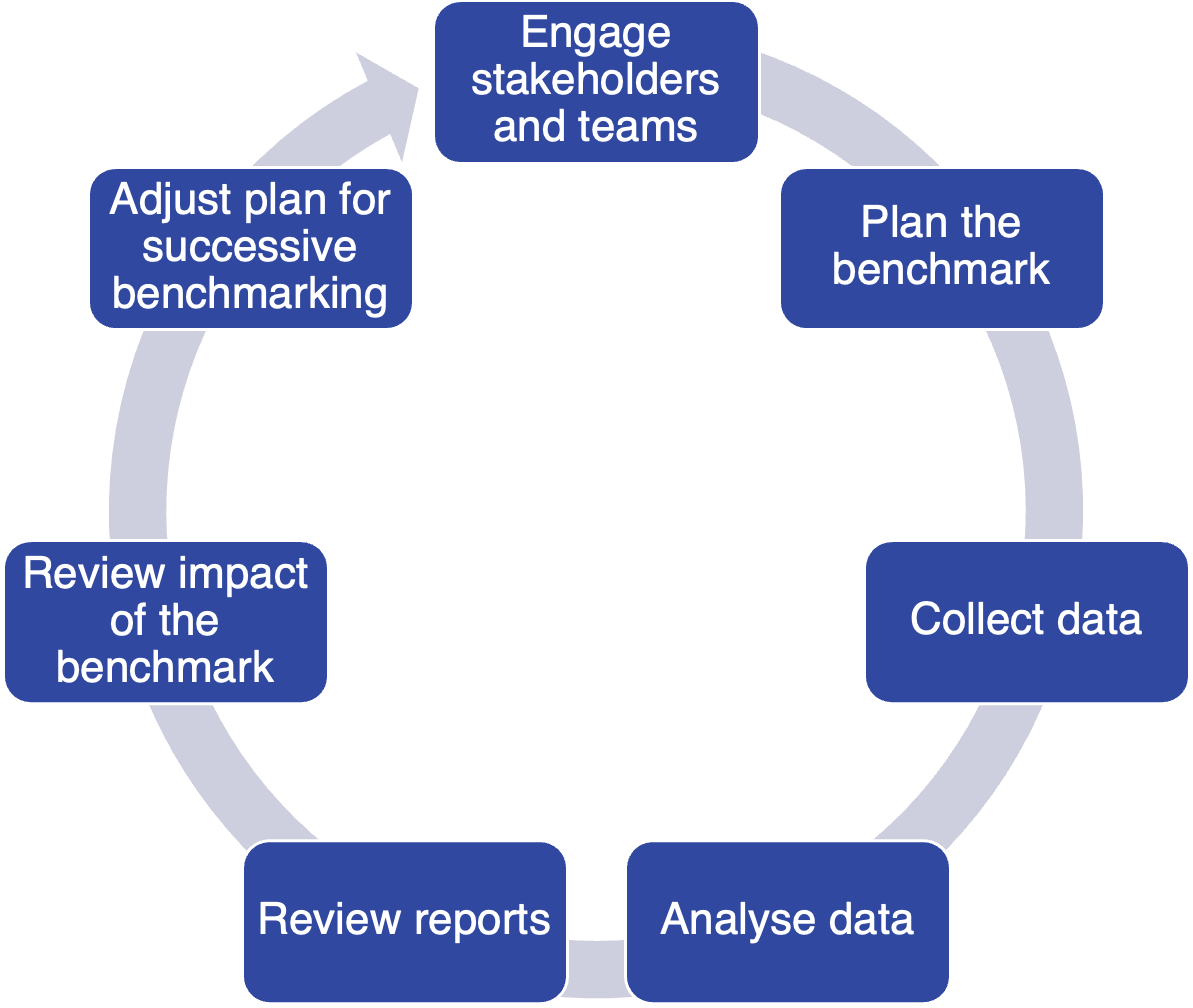

What is the best benchmarking process?

Too often, benchmark reports disappear in the junk drawer. This not only happens because of inadequate benchmark reports but also because too few teams use the benchmark report to its full potential.

It requires a deliberate and structured benchmarking process across the organisation, involving multiple stakeholders and teams, to have a significant impact on your service business.

Parts of this process can be outsourced to an organisation that is offering the benchmark services.

Engage stakeholders and teams

For the best result further down the road, the best approach for benchmarking is to engage the stakeholders and teams whom you need to be working with the benchmark findings early, that is, before conducting the benchmark and processing the benchmark reports.

The aim is first to get them on the same page regarding:

- What is the objective of benchmarking? What do you want to improve?

- Specific questions to get answered.

- Expected deliverables.

- What to do with the deliverables.

Plan the benchmark

Plan the benchmarking project together with the teams and stakeholders.

Key topics of this plan are:

- The scope of the benchmark:

- What areas to benchmark?

- What part of the service business to benchmark?

- What metrics to benchmark?

- What kind of benchmarking to conduct and how?

- Which reference groups (industries, companies, types of industries, product, services, and geographies)?

- Designated roles in the benchmark, like providing data, conducting surveys, internal coordination, communication, etcetera.

- Allowable resources and time for collecting the data and conducting the surveys.

- Deadlines and timeline.

Maybe you also want to agree on:

- Sources for the required data.

- In case of repetitive benchmarking, saving queries and some level of automation for data capture.

- To which extent to secure anonymous surveys for employees, particularly when surveys about their opinions are involved.

- Confidentiality, data security and privacy regarding company data and personal data of your employees.

Collect data

After planning, benchmarking is about collecting information and data of your own company and your reference groups.

To avoid comparing apples to oranges, it is vital to establish clear definitions of the metrics and business capabilities you are benchmarking.

Analyse the data

Once you feel you have all the information you can gather, you can properly analyse the data.

It is important to remember that no business is perfect, and you can only learn from an open and objective analysis. This requires an open and unbiased mindset.

In essence, benchmarking is not just about numbers and metrics. It is about:

- Gaining valuable insights.

- In the proper context.

- Understanding the stories behind the numbers.

- Seeing the (early signs for) trends over time.

Ideally, you involve a broad set of (internal and/or external) experience, backgrounds, and expertise in the analysis.

Once findings start to be uncovered, you can prepare the reports.

Review findings

The aim is to generate impact and action from service benchmarking. Before taking any decisions or actions from the benchmark reports, it is vital to share the findings with all stakeholders and teams and to organise an adequate review and dialogue.

This review should cover:

- Strengths and how to leverage these.

- Weaknesses and which ones to solve.

- Links to specific characteristics and strategies of your business.

- Main opportunities to pursue.

- The (potential) threats to monitor and mitigate.

This applies to strategic management, operational management, innovation, and continuous improvement programmes.

As benchmarking is not the only source for insights, it is a good practice to also:

- Link the benchmark reports to other insights and sources, like customer research and industry research.

- Identify the unanswered questions or omissions in the data and insights.

Review impact of the benchmark

A plan is never complete without monitoring results to determine the success of the plan.

So, after every benchmarking exercise, it is useful to review the:

- Results from the benchmark.

- The impact and use of the benchmark reports.

- The data capture and analysis activities.

- The adoption and acceptance of the benchmark findings.

- How it affected the quality and process of decision-making.

Adjust plan for successive benchmarking

Based on the results and the review of the benchmarking, you may want to agree and decide how to execute the next cycle of benchmarking. Topics to cover are:

- Scope of the benchmark (which capacities and metrics).

- Coverage of the benchmark (which business lines, regional entities).

- Which sources to use for the benchmark.

- Who to involve in the benchmark activities.

- How to leverage the benchmark reports and drive action.

- How to use benchmarking to follow up and monitor the progress and results of your service initiatives.

What is the cost for service benchmarking?

Good service benchmarking costs much more than the effort or price to capture the external data.

You also need to:

- Capture data internally, which requires a significant effort from several individuals in your company.

- Set up an adequate plan of what to benchmark and how to use the benchmark.

- Engage your stakeholders in advance to get the maximum value from the benchmark.

- Review the report and insights to translate them into your own business.

- Follow up on the benchmark, close the feedback loops and plan for the next cycle of benchmarking.

Both external cost and internal cost for benchmarking depend on:

- The size of your company.

- The scope of the benchmark you want to conduct.

- The number of subsidiaries you wish to involve in the benchmark.

- How readily the required data and information is available in your company.

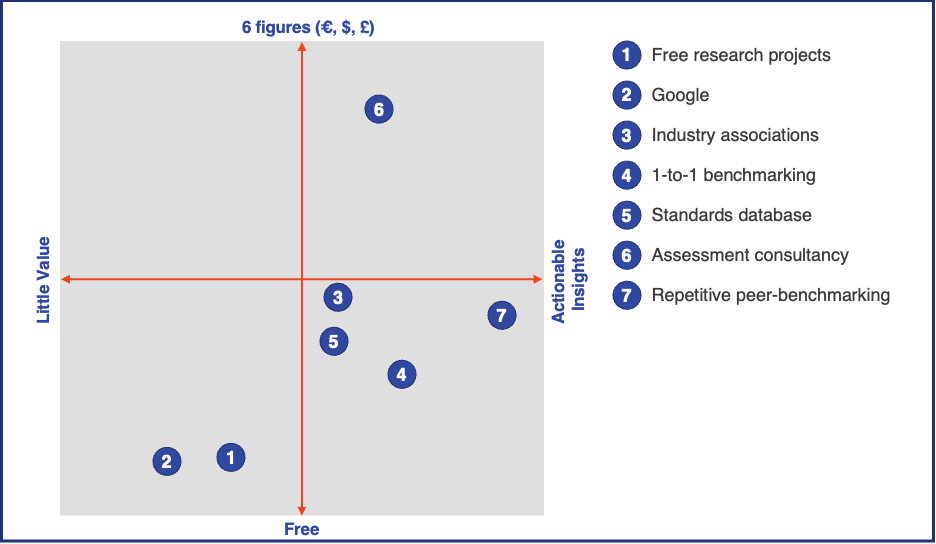

The out-of-pocket price for a benchmark service ranges from free up to five or six figures (in EURO, USD) for a multi-billion revenue business (see Figure 1 - Cost - Value Matrix of benchmarking sources above).

However, standardised annual benchmark services, with a high number of participants and little involvement of consultants in the process, should be relatively affordable. The out-of-pocket cost for these benchmarking services will not have any impact on your decision to use them or not.

What are the limitations of benchmarking?

In essence, benchmarking is only one of the sources you need to:

- Assess your service business.

- Identify potential threats, opportunities.

- Understand your strengths and weaknesses.

- Inspire your teams to identify best practices.

- Develop your strategy and drive your continuous improvement programmes.

So, benchmarking is not the only source to rely on.

Furthermore, benchmarking does not:

- Provide you with the single source of information you need.

- Dictate solutions, silver bullets or decisions. It does not take into account strategic factors and choices of your company or competitors.

- Tell you what the performance objectives or targets for your company should be.

What are common mistakes?

Service benchmarking is much more than receiving and sharing a benchmark report. It is all about gaining strategic insights and making sure your organisation acts on the data and insights. This also requires capturing the correct data and insights.

Here are some common mistakes made with service benchmarking:

- Not analysing and interpreting the benchmark reports or drawing your own – company-specific – conclusions.

- Not taking specific decisions or agreeing on actions.

- Setting up too vague objectives for the benchmarking in the preparation phase.

- Only benchmarking financial data and performance metrics.

- Blindly ‘copying’ what competitors or other service businesses do.

- Capturing too high level and generic data and insights.

- Not getting stakeholders and users of the benchmark on board at the start of the benchmark.

- Using outdated data sources as the benchmark.

Download for later reading (PDF)

The Complete Guide

Everything you need to start benchmarking your service business today.